Predicting the future… by observing the past

How did real estate markets emerge from previous economic downturns? And can those experiences help steer us this time?

In a 1948 speech, former British Prime Minister, Winston Churchill, paraphrased the philosopher George Santayana, saying: “Those who fail to learn from history are condemned to repeat it.” Economists and real estate researchers rely heavily on looking backwards for comparative periods on which to base their forecasts, though the latest crisis has challenged this methodology – given that it has no precedent in modern history.

Of course, while some commentators are fans of looking backwards, others embrace neologisms and the hunt for the new and exciting. Over the past year, it is these types of pundits and forecasters who have carried the real estate debate, with their rallying cry being that the industry must prepare for a new normal.

My view on the outlook sits somewhere between the two camps. While the circumstances that led to this crisis are unique in modern times (and undoubtedly will have some unique effects on real estate), the key driver of the markets over the next five years will be the fact that Covid-19 drove the world into recession. Thus, an examination of what trends were common coming out of previous local, regional and global recessions should give us a good steer of how things may evolve.

Risk on / off

The most obvious recessionary and post-recessionary trend, and not just in real estate, is around attitudes to risk. Generally, recessions are often caused by an overly relaxed attitude to risk, and thus the inevitable post-recessionary trend is to move to a risk-off approach.

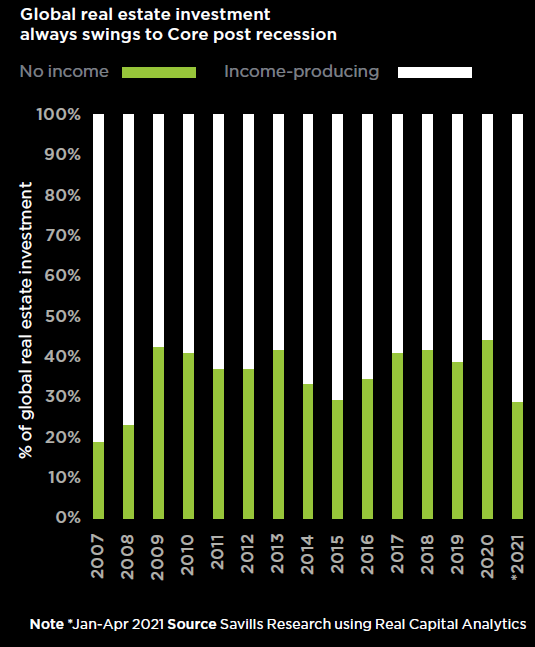

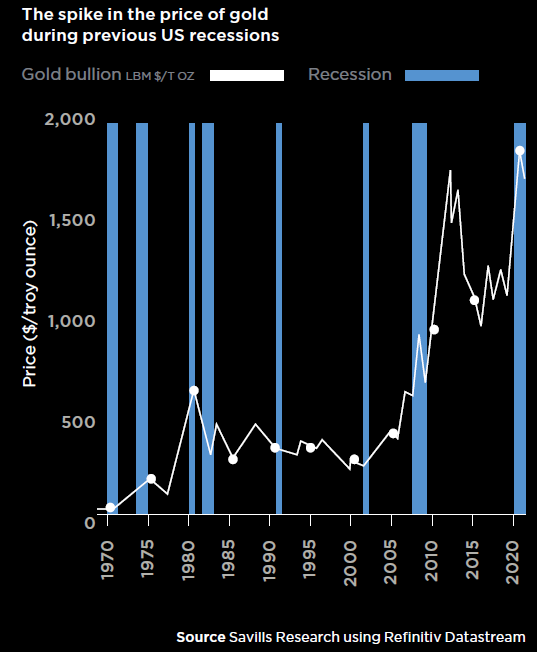

This trend can be seen in as diverse areas as the spike in the price of gold in some previous recessions (see below), the rise in Covid-19 friendly equities last year, or the swing towards Core assets in the world’s real estate markets.

In 2021, there has already been evidence of this swing occurring, with 71% of the real estate investment deals that have happened globally in the first three months of the year being on Core income-producing assets. Putting this another way, we always see less investor interest in development opportunities immediately after a crisis (more on this later).

What does risk off look like?

In the real estate world, a swing to low-risk investing has always been characterised by a rise in interest in long-leased assets, and a reduction in interest in assets that have voids and are subject to occupational risk.

At a national level, it is also common to see a migration of investors away from regional markets in favour of the capital city. In the UK, for example, London accounted for nearly 70% of all investment activity after the last two recessions (a rise from its normal level of around 50%). Whether this decision is rational is debatable, as while capital cities are always more liquid, they also tend to be the most volatile markets in pricing terms.

Immediately after all of the past three recessions, we saw a sharp rise in global investment flows into income-producing CBD offices and multi-family housing, sectors that have always been perceived as lower risk in times of uncertainty. There was also a swing away from sectors that emerged from the recession looking over-supplied, with the most common victim of this aversion to risk being retail property.

The emergence from this downturn feels different. In theory, property looks to be very good value relative to other asset classes, but the gap between income received and income receivable is challenging many investors – and is unique

James Lock, Managing Director of Real Estate at Blackstone, says: “How sectors emerge from a period of economic distress will vary dependent upon the underlying headwinds and tailwinds impacting each. However, our investment approach has always been centred around taking the long view; looking through periods of volatility and investing in high conviction sectors that align with our thematic investment views, and that are experiencing and benefiting from complementary structural change. As such, our attitude to risk will be influenced by near-term recessionary considerations, balanced against a longer-term view.”

As Lock suggests, some trends that were prevalent before the latest crisis hit are being amplified, whether it be the swing from traditional bricks-and-mortar retail to logistics, or a focus on wellness in the workplace. This has pushed some segments of the property market deeper into Core territory, leading to an overwhelmingly common investment strategy across many types of real estate investors in 2021 that is best summarised as ‘beds, sheds and meds’.

Andy Allen, Head of Product Strategy & Development at Savills Investment Management, says: “Often, investors are slow to recognise the emergence from recession, and cautious of the signals of recovery. We expect Core investors to continue to target, at scale, the durable income that real estate can provide, and Value Add strategies to be polarised towards ‘beds and sheds’ rather than in offices and retail where greater uncertainties prevail. Of course, history tells us that sentiment often overreacts, and this in turn will create opportunity in presently unloved sectors.”

What happens next is fairly predictable. As an increasing number of investors cluster around locations, sectors and assets that are perceived as lower risk, prices start to rise and returns begin to reduce. As one fund manager that I spoke to put it, “our investors soon realise that Core is low-yielding, and as economies recover, the lure of higher returns for higher risk reasserts itself.”

Will things be different this time?

The cause of the latest recession is unique in modern times, so it is not unreasonable to assume that some of the trends that will be prevalent post-recession will also be new. The governmental response to the Covid-19 crisis has also been unprecedented in terms of the volume of fiscal and monetary support that has been committed.

Bill Page, Head of Real Estate Markets Research at Legal & General Investment Management, sees these external factors as important, while suggesting that old ways of property investing should also remain integral to stock selection. He says: “The emergence from this downturn feels different. In theory, property looks to be very good value relative to other asset classes, but the gap between income received and income receivable is challenging many investors – and is unique. Property allocations, alongside other asset classes, will need to be more targeted as investors cannot ride a general wave of recovery. Sector and segment calls, and/or specific investment styles, will become far more important.”

At the start of 2021 it is clear that some investors are questioning whether CBD offices are quite as Core as they have been coming out of previous crises, and I do not expect that this question will be answered until social distancing measures have been completely removed. However, this remains the largest and most liquid part of the global investment universe and this alone is likely to support its position.

Richard Spencer, Partner, Real Estate Investing at Goldman Sachs Asset Management, adds: “In the office sector, tenants and investors will gravitate to best-in-class buildings, offering leading environmental performance, digital connectivity and employee experience. We call this the K-shaped recovery: a growth opportunity in some asset classes and a potential new cycle of value and distress in others.”

New sectors of choice are also evolving from this crisis, and Simon Hope, Head of Global Capital Markets at Savills, suggests that “we have got to be looking at the sectors of the future, not the past”. These include multi-family housing, ESG compliant assets of all types, science and research-focused properties, and data centres.

Finally, there is the question of development, the part of the real estate universe that normally is quietest in post-recessionary periods. I believe that this will bounce back more strongly this time around, driven by a global desire for better places and spaces, as well as the more normal need to repurpose assets that the recession and structural change have made surplus to requirements. This is likely to be a less competitive part of the global real estate environment over the next 12 months, but also has the potential to deliver the highest returns.