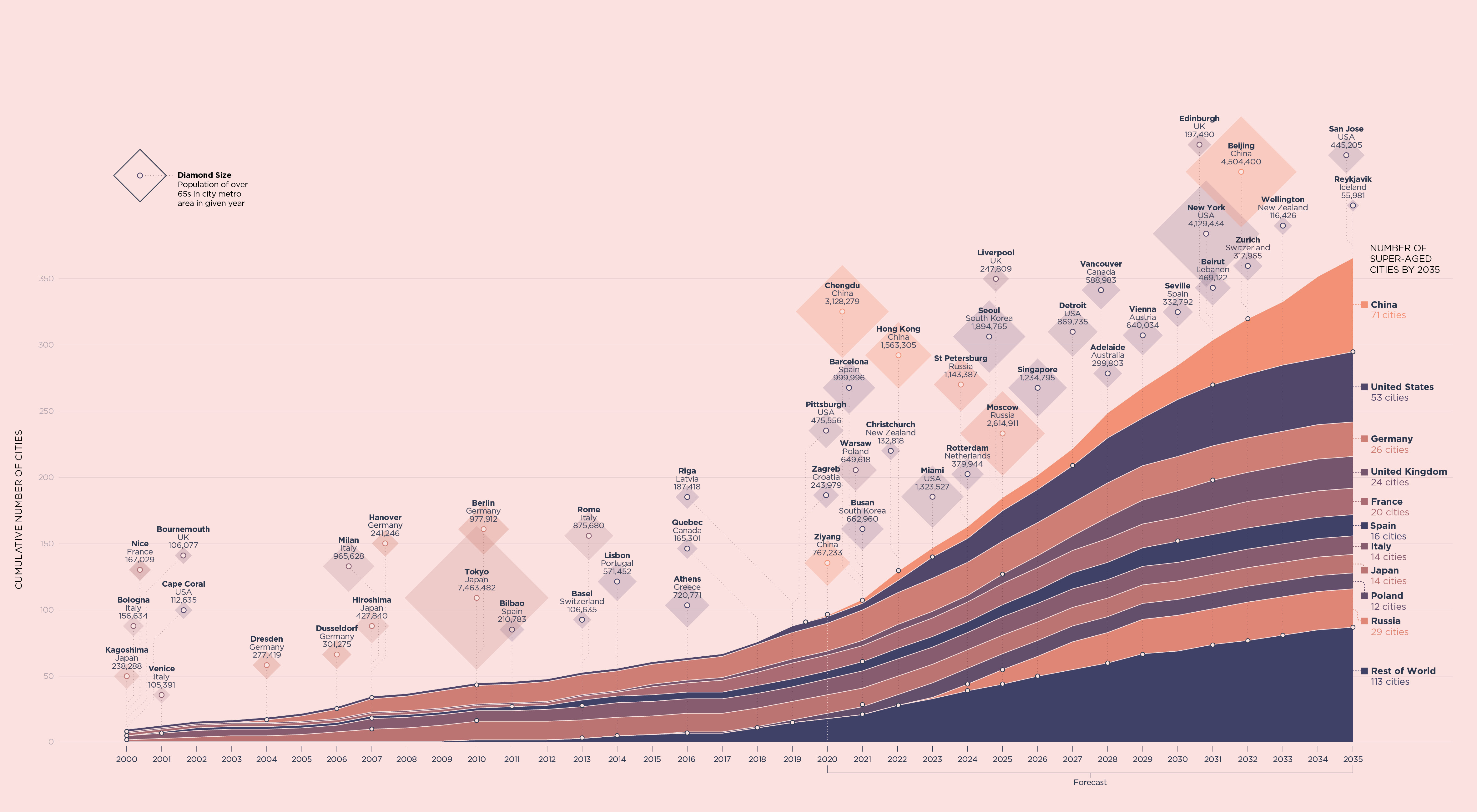

Timeline of super-aged cities

The year when the over-65s in each city made up more than 20% of the overall population of that city. Cumulative number of cities per country. Click to see an expanded version.

Source: Savills Research using Oxford Economics

As life expectancy increases and people live healthier lives for longer, the question of where and how the ‘super-aged’ are going to live can’t be ignored. They may be over 65, but this is a youthful, healthy and mobile group of people.

For real estate investors, it’s an opportunity. Here, we discuss the scale of the issue, which countries are leading the way, and the need for sensitivity to cultural and social differences. We also profile five global models for housing with care.

Super-aged tipping point

According to the UN, we’re on track for the worldwide number of over-65s to more than double to 1.5 billion by 2050. But many cities are already at a tipping point where the 65-plus make up more than 20% of the population. These cities are mainly in Japan, Germany, Italy and France. Joining them soon will be Russia, Spain, Poland and the USA. By 2035, China will have 71 super-aged cities and the USA will have 53.

This creates a major opportunity in ‘housing with care’ – a range of residential formats for older people that have broad appeal for investors. At its core, housing with care recognises this generation’s ability to live independently for longer, but it also offers the benefits of being part of an organised community.

From independent-living housing schemes and retirement villages through to those with light-touch support, such as assisted living or extra care, it’s a gap that needs to be filled. Yet, it’s underdeveloped in many markets and requires an understanding of cultural, regulatory, and operational factors to unlock the growth.

Global leaders in housing with care

We can learn from countries such as New Zealand and Australia, global leaders with major listed and private players who own large portfolios of retirement villages. Here, a transparent regulatory foundation for what operators and residents can expect has tipped the sector into meaningful growth. The USA, the most mature market globally, offers transferable lessons on integrating diverse housing formats and tenures on one campus.

However, market entrants need to be mindful of cultural and social differences. The relative vitality of future generations means that more are likely to be nationally or internationally mobile, and will want their housing to reflect this.

Culture and ageing in place

For now, those with a more traditional attachment to their family home tend to be falling in line with government policy, which is to encourage ‘ageing in place’ or providing services in the family home. Singapore, for example, encourages downsizing, while supporting ageing in place by offering bonuses or promoting multi-generational living in apartments suited to three generations of family.

Prioritising ageing in place could change for many markets if more of the right kind of product shows the benefits of communal living (which also frees up traditional housing stock).

There are also traditions around caring for older generations. In Asia, culture dictates that parents are cared for by their children in old age. In China, it’s the law. Taiwan cuts off the inheritance of neglectful children. While these deep-held beliefs might make these markets appear more challenging, just a small proportion of housing with care in each would offer huge investment potential.

Five global models for housing with care

Above: Emerald Lakes, Gold Coast, Australia

Housing with care is set to become a major alternative sector for investors. Think of it like student housing – operational assets that quickly became mainstream for many investors. It bears the hallmarks of why to invest in residential alternatives: a deep and growing demand, a lack of supply in many markets as well as a consistent and secure rental income.

“The market is moving towards a more flexible offering of tenure, with both traditional sale and rental models now being offered,” says Samantha Rowland, Savills Head of Senior Living.

Marcus Roberts, Head of Savills European Operational Capital Markets, adds: “With an attractive supply/demand imbalance, the potential for long-term stable income profiles and the chance to diversify from traditional sectors, housing with care presents real estate developers and operators with significant opportunities across Europe and beyond.”

Definition: In these models, housing with care includes independent living, assisted living, retirement villages and extra care (excludes nursing homes or residential homes).

1. Established for-sale markets

Innovators: New Zealand and Australia

New Zealand

Housing with care units: 30,000

Number of over-65s: 770,600

Provision rate* 3.9%

Australia

Housing with care units: 170,700

Number of over-65s: 4,055,300

Provision rate*: 4.2%

UK

Housing with care units: 75,000

Number of over-65s: 12,409,160

Provision rate*: 0.6%

Once the ground rules for residents and operators were set in the Retirement Villages Act (2003), the New Zealand market took off. Regulation introduced transparency to the complexity of service charges and management fees.

Most New Zealand retirement villages offer an ‘occupational right agreement’ rather than freehold, with 30% of the upfront cost deducted at the end of the tenure in addition to ongoing service charges. The deferred management fee structure is now common in established markets, such as Australia and the UK (although with less clarity in the latter). As market leaders, Australia and New Zealand are now responding to demand from their high-end clientele by moving from traditional low-density retirement villages to increasingly urban and high-density housing.

“In the next decade, the number of over-65s in New Zealand will increase by almost 40%,” says William Wallace, General Manager, Savills New Zealand. “As one of the most mature later living markets globally, we expect to see innovation in the range of housing formats on offer to residents.”

2. Integrating housing with care

Innovators: USA and Germany

USA

Housing with care units: 1,354,000

Number of over-65s: 53,953,700

Provision rate*: 2.5%

Germany

Housing with care units: 320,000

Number of over-65s: 18,037,100

Provision rate*: 1.8%

The USA has found depth in its mature market by creating a diversity of tenure and types, and often integrating those offers on one campus. Continuing care retirement communities combine all options, from independent living to skilled nursing.

The USA was also an early-adopter of cross-generational living with its university-based retirement communities such as Lasell Village in Massachusetts. These put housing on university campuses, giving residents access to the amenities and classes as well as the university hospital.

Germany is also moving towards an integrated approach. Three tiers of offers range from basic assisted living to top-end services, with the fastest growing mid-range category, which includes cultural services. These formats often sit alongside care homes and can include other adjacent occupiers, such as regular market housing.

3. The rental concept

Innovator: France

Housing with care units: 47,000

Number of over-65s: 13,478,300

Provision rate:* 0.3%

France is innovating by adapting the rental model for the older generation. It is the same concept as student housing or build to rent, but with more communal space and services. The focus is on urban living, with many schemes close to transport and shops.

“Senior housing is a gateway into the heavily regulated residential market,” says Lydia Brissy, Director of European Research, Savills. “The services associated with senior housing give it a more commercial dimension, and it depends on different regulations to the traditional housing market. The senior housing rental concept has been expanding rapidly, thanks to tax incentives for private individuals to invest in single units.”

For Domitys, one French developer and provider, the approach has proved successful, with an average 98% occupancy rate for stabilised assets. In the Netherlands, its track record in care has translated into housing that emphasises integration with the wider community. Examples include De Rokade in Groningen, centrally-located ‘young senior’ housing in a modern tower with public amenities, and Maartenshof, a city-block with 200 day-care and nursing beds, sheltered housing and a kindergarten.

Above: Kampung Admiralty, Singapore

4. Family ties in Asia

Innovators: Singapore and China

Singapore

Number of over-65s: 832,800

China

Number of over-65s: 164,799,900

The response to the ageing crisis across Asia continues to rely on the cultural norm of family support. China expects 90% of elderly care to be provided in the home, but with 147 million over-70s in the next decade, this is a large market. Lendlease has made a start, developing an 850 resort-style senior living community near Shanghai.

“While opportunities for international providers are likely to be plentiful in China, there have been false starts in the past,” says James MacDonald, Savills Head of Research in China.

“Investors need to engage with the right local partners, understand the regulatory environment and thoroughly study the market. Operators and investors should understand affordability and the willingness to spend. Money is invested on the young not necessarily on the elderly.”

Singapore’s plans are also family dependent as it innovates with its existing stock. There are bonuses for downsizing and incentives for parents and adult children to live within 2km of each other (qualifying for Housing and Development Board housing). HDB’s first retirement project, Kampung Admiralty, is inter-generational living for anyone aged 55 or over.

5. A new template for later living

Innovator: Japan

Housing with care units: 300,000

Number of over-65s: 35,297,700

Provision rate*: 0.8%

In 2000, Japan replaced its dependence on family support for its senior citizens and put in place mandatory long-term care insurance, Kaigo hoken. Here, over-40s pay up to 2% of their income, with central government contributing the rest. This framework has led to a large and mature market; Japan has multiple healthcare REITs, including diversified and residential REITs with exposure to the sector, while private equity players have also invested.

The range of housing formats offers varying levels of nursing care and support. Capitalisation rates have compressed substantially since the first healthcare REIT launched in 2013, and now just have a small premium over residential assets. “The healthcare real estate market is still finding its legs,” says Tetsuya Kaneko, Head of Research and Consultancy, Savills Japan. “Demand for nursing care and medical services is set to continue growing, so early entrants have the potential to gain a valuable foothold.”

*Provision rate is number of housing with care units/population of over-65s. Source: Savills Research, Oxford Economics, ABS, NIC, dcpc – Deutsche Care Property Consulting GmbH, ARCO. Kampung Admiralty image: Patrick Bingham-Hall