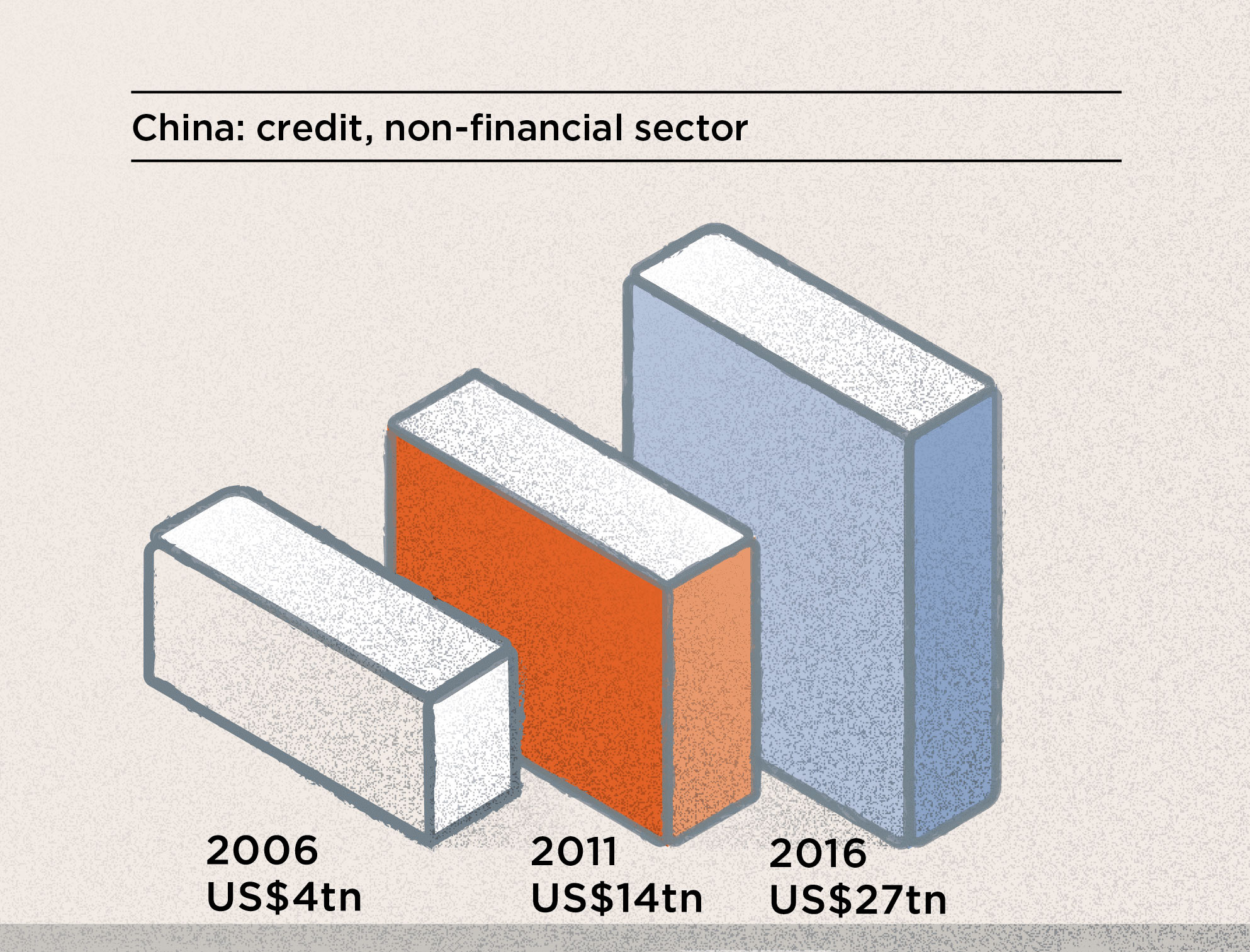

1. Chinese debt has grown

Levels of Chinese debt increased by 575% in the 10 years between 2006 and 2016.

Source: Bank for International Settlements (BIS)

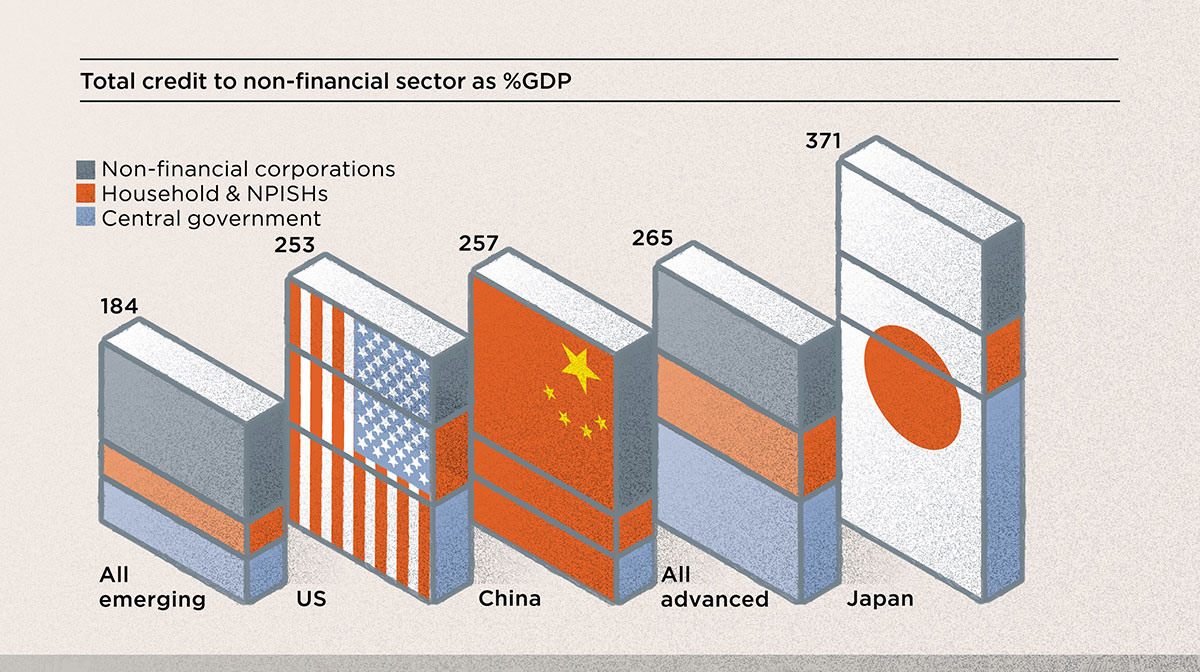

2. The ratio of debt to GDP is about the same in the US and China

Chinese debt is just over two and a half times its national gross domestic product (GDP) – slightly lower than the average for all advanced economies. But China’s higher GDP growth means that this multiple could diminish fast.

3. Chinese debt is low. And different

Debt in China is US$20,000 per capita compared with US$145,300 in the US and US$134,000 in Japan. Although most Chinese debt is corporate, most is also state-owned, so bad debts can be dealt with differently. Typically, loans are rescheduled, debt securitised, and ‘zombie’ companies merged with solvent ones.

Source: BIS

4. A debt problem in China is unlikely to be contagious

Most Chinese debt (95%) is domestic, not external. So, not many overseas creditors are at risk and any problems are much less likely to result in a global financial crisis. China’s official reserve assets of US$3.2 trillion more than cover all external debt.

Source: World Bank

5. China’s household debt is in line with emerging economies

Outstanding credit to Chinese households stands at 44% of GDP, compared with 80% in the US and 74% in all advanced economies.

Source: BIS

6. Savings ratios may be more important for real estate

China’s high savings ratio (36% of disposable income) could be more significant than debt in house price inflation. Few domestic savings and investment vehicles, coupled with a desire to retain and store household wealth, results in a large amount of capital being directed into housing.

7. Not all debt is associated with real-estate bubbles and economic crises

Japan has had high overall debt levels but slow deflation in property prices since the early 1990s. The US has high and growing levels of government debt-to-GDP ratios – but stricter regulation of mortgage lending through international banking regulations, such as Basel IV, has curbed household debt.

8. Lending regulation has had a substantial impact on real estate

Regulation means less cash flowing into new projects, development and investment compared with the recovery stage of other cycles. Global transaction volumes have been lower than they might otherwise be.

While this means less danger of real-estate oversupply, capital is tied up in assets and is not being used to drive new development. So, real-estate rents may hit ceilings based on economic growth and productivity but have little scope to adjust downwards while supply is constrained.

9. Is Basel IV shutting the stable door after the horse has bolted?

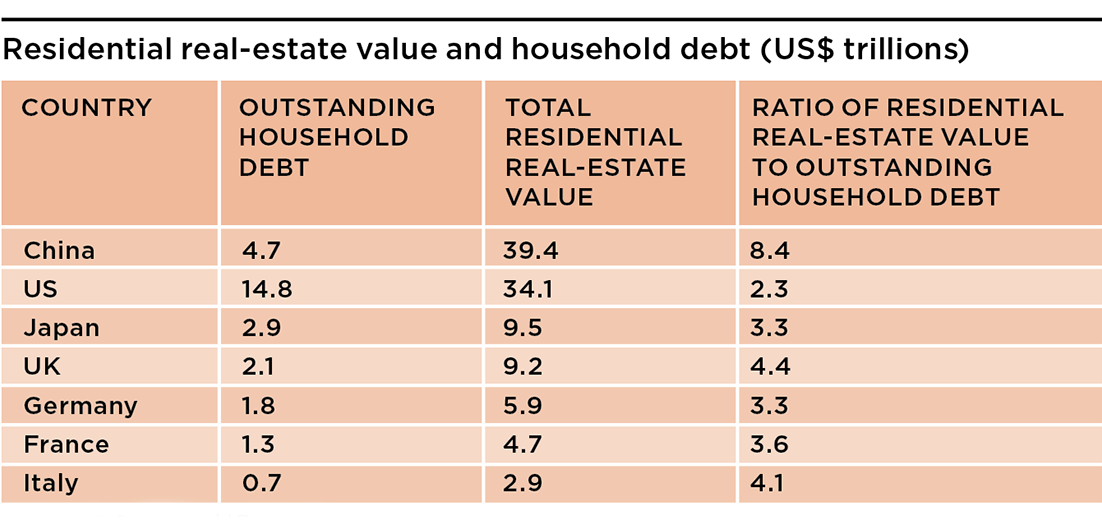

Secured lending remains low in many developed economies and asset values more than cover it. Only in the US is the value of residential real estate less than three times the level of outstanding household debt. China’s residential market has a theoretical asset cover of more than eight times as much.

Source: BIS, Savills World Research

10. The future for lending and real estate may be different to the past

The lending and owning environment has polarised. Older generations in advanced economies have large amounts of equity tied up in real estate. Younger generations in the same countries as well as people in emerging economies have not accumulated real-estate capital, and unsecured debt levels have risen. This global phenomenon may have more far-reaching consequences than the conventional banking debt and real-estate cycles of the past.

A credit squeeze in the unsecured sector could be just as drastic as a classic banking crisis, especially if it results in low consumer confidence and moribund consumer spending. There may be few mortgage repossessions and forced sales driving prices down in these circumstances. But, on the other hand, there is little investment activity or rental growth to drive prices up. Real-estate markets do not crash in these circumstances, they stagnate.